The average S&P 500 company must generate more than $1.05 billion in growth by the end of 2016 just to meet shareholder expectations.

For sure, the fuel of easy money presents a tradeoff between striking as hard as possible while the iron is hot and ensuring that the fires lit in favor of growth don’t burn out of control—or on the extreme other hand, aren’t put out by resistance to these lucrative new growth strategies. For instance, a study from the Economist Intelligence Unit shows that 61% of strategies dramatically underperform due to execution.

From personal experience when engaging new clients, Berdeo Group almost always finds leaders still trying to integrate cutting-edge ideas from several years past or, even worse, having halted in a hybrid/in-between state. Strategic mergers remain half integrated. New branding has only been adopted by the highest performing organizations. Full-service ERP solutions remain interfaced to hundreds of legacy bolt-on systems.

You experience the effects of this half-way state day-in and day-out.

Repercussions we typically see, just to name a few are:

- Leaders, managers, and other employees across the organization are uncertain and misaligned, resulting in bad execution.

- They also continue doing what they have been incented to rather than responding to the incentives inherent in the new strategy.

- Outsized percentages of annual budgets are devoted to supporting in-between states that could otherwise be reinvested in further growth, to further engage/attract employees, or be distributed back to shareholders.

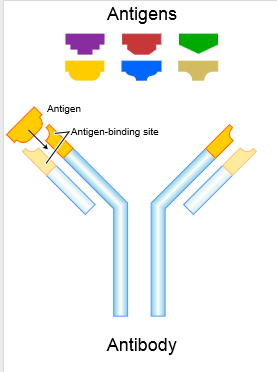

To put the pathology of this problem into context, think of your company as the human body. New ideas are introduced, a lot like an antigen (or foreign body) entering the human body. These ideas are then attacked by resistant “antibodies” designed to protect operations, focus staff, or deliver existing commitments to customers- a kind of inertia at all costs.

To put the pathology of this problem into context, think of your company as the human body. New ideas are introduced, a lot like an antigen (or foreign body) entering the human body. These ideas are then attacked by resistant “antibodies” designed to protect operations, focus staff, or deliver existing commitments to customers- a kind of inertia at all costs.

You should view these antibodies, in a way, with pride. After all, it is loyalty to robust prior direction established within your organization that has created them.

But in moments where you want to take these antibodies out of action, you must predict where they will attack.

What’s more, once the reactions of these antibodies are identified, you as executives and leaders—and your direct reports—must do much more than just communicate the new vision and direction. Sometimes, perhaps, we put too much faith in our communication skills and even when they are topflight, the messages can fall on deaf ears. A true leader also needs to have the wherewithal to aggressively unlock organizational capacity to effectively execute. This will stop the antibodies in favor of new, more effective and productive tactics, overcoming natural operational inertia.

How is this done? CEB research shows that companies successfully deploying new growth strategies apply three key steps:

- Ensure continuous executive alignment with strategic goals,

- Empower business and functional leaders to terminate projects and practices misaligned with the new vision, and

- Discourage old behaviors impeding new strategies.

The biggest initial challenges in accomplishing the above are:

- The fact that often junior leadership and line management have the power of the “pocket veto” that can widen the gap between corporate strategy and execution, and

- Getting over the classic head nod of agreement with the strategy, with a lack of action—effectively failing to convey the potential future rewards or detriments of living in a half-implemented strategy.

Attention to Behaviors

What’s more, unlocking capacity includes deliberate planning around not only what program-level initiatives will be eliminated, changed, or preserved, but also intentional preparation for the underlying behavior changes. For example, a retail store staff might continue to focus on operational performance (such as speeding the customer through the store) when the new strategy calls for emphasizing deeper customer insight, conversation, and advice about product features and options. When legacy behaviors persist, the momentum behind new strategies quickly erodes.

Specifically, in rolling out new growth strategies, managers are the crucial layer for successful behavior change. Getting these key actors to abandon their own misaligned or outdated legacy behaviors in favor of those supporting new growth strategies allows them to better promote a new set of behavioral rules to employees at large. With the assistance of senior executives and organizational change specialists who can articulate the new strategies, their underlying motivations, and inherent behavior changes, they should:

- Identify Key Behaviors for Strategy Success: A behavior plan identifying desired behaviors directly aligned to new strategic goals should precede the creation of any task-based action plans. This provides an explicit connection between strategic priorities and the behaviors required to execute the strategy— something most organizations leave as implied but the best make concrete and specific.

- Challenge Accepted Behaviors: Surface those disruptive legacy behaviors by explicitly comparing current and desired behaviors in a collaborative setting. Doing this in groups helps to flag where current behaviors supporting older strategies may conflict with new ones and helps those needing to change buy into the philosophy of the new world.

- Drive Commitment to Stop Legacy Behaviors: With the close involvement of managers, a “let it go” list of legacy behaviors should be created and incorporated into individual development or performance plans, ensuring commitment to provide evidence that legacy behaviors are being eliminated, new behaviors are being adopted, and progress is tracked over time.

Rolling out the new strategies necessary to meet the momentous goals that companies have set for themselves in 2016 will undoubtedly bump against the age-old issue of new growth—resistant antibodies. Deliberate planning, unlocked capacity, and a laser focus on eliminating old behaviors will be key to proper execution, a cornerstone upon which the medium-term wealth of our nation rests.

This article originally appeared on Huff Post December 17, 2014